Latest News

Lemonade stock more than doubled in 2025. Here's why Wall Street is warming up to this AI-powered insurance disruptor.

Via The Motley Fool · January 13, 2026

On Jan. 13, 2026, fresh analyst skepticism clashed with big AI infrastructure ambitions, putting Super Micro's profit outlook in focus.

Via The Motley Fool · January 13, 2026

The AI computing market is expected to expand through at least 2030.

Via The Motley Fool · January 13, 2026

As of January 13, 2026, the global financial landscape has entered a period of "controlled panic." The traditional market mechanics of the last decade have been upended by a sharp resurgence in the geopolitical risk premium—the extra yield investors demand to compensate for the threat of war, trade disruptions,

Via MarketMinute · January 13, 2026

Today, Jan. 13, 2026, investors weigh AMD’s surging AI data center momentum against a somewhat lofty valuation.

Via The Motley Fool · January 13, 2026

The U.S. financial landscape shifted gears on Tuesday as the Bureau of Labor Statistics released the highly anticipated Consumer Price Index (CPI) data for December 2025. With Core CPI coming in at a lower-than-expected 2.6% year-over-year, the U.S. Dollar faced renewed pressure, continuing a downward trajectory that

Via MarketMinute · January 13, 2026

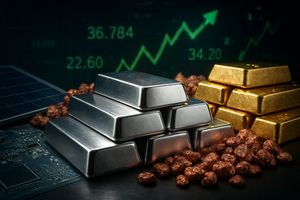

The global metals market reached a historic milestone on January 13, 2026, as silver futures settled at a staggering $85.877 per ounce. This monumental surge marks a definitive transition for silver, moving it from a speculative precious metal to a critical industrial-monetary hybrid asset. The rally is not an

Via MarketMinute · January 13, 2026

The global financial landscape reached a historic turning point on January 13, 2026, as Japan’s Nikkei 225 index surged to a record close of 53,549.16. This milestone, representing a monumental leap from the psychological 50,000-yen barrier breached only months prior, signals a fundamental shift in how

Via MarketMinute · January 13, 2026

Via MarketBeat · January 13, 2026

As of mid-January 2026, the global financial markets are caught in a tense "wait-and-see" pattern. Investors are increasingly jittery as the delayed inflationary effects of aggressive 2025 trade policies begin to manifest in consumer prices. While many corporations spent the latter half of last year absorbing tariff costs through existing

Via MarketMinute · January 13, 2026

On Jan. 13, 2026, positive inflation data wasn't enough to bouy banking stocks today after mixed results from JPMorgan.

Via The Motley Fool · January 13, 2026

The U.S. labor market greeted the new year with a message of calculated resilience. Data released in early January 2026 by the ADP National Employment Report revealed that private sector payrolls rose by 41,000 in December, a figure that largely aligned with consensus expectations. This measured growth signals

Via MarketMinute · January 13, 2026

The U.S. Treasury market reacted with calculated precision on Tuesday following the release of the December Consumer Price Index (CPI) report. While the headline inflation figure remained unchanged at a 2.7% annual rate, a slight "downside surprise" in core inflation triggered a rally at the front end of

Via MarketMinute · January 13, 2026

BOISE, Idaho – As of January 13, 2026, the financial markets are witnessing a historic transformation in the semiconductor landscape. Micron Technology (NASDAQ: MU), once a company defined by the volatile boom-and-bust cycles of the commodity memory market, has completed a two-year metamorphosis into a high-margin powerhouse at the center of

Via MarketMinute · January 13, 2026

The shipping courier faces daunting near-term headwinds.

Via The Motley Fool · January 13, 2026

The little eVTOL maker still has a lot to prove.

Via The Motley Fool · January 13, 2026

On January 13, 2026, Travere Therapeutics (NASDAQ: TVTX) faced a sharp reversal of fortune as the U.S. Food and Drug Administration (FDA) announced a three-month extension for its review of Filspari (sparsentan) for the treatment of focal segmental glomerulosclerosis (FSGS). The news sent shockwaves through the biotech sector, causing

Via MarketMinute · January 13, 2026

Investors should look for value and diversification in a very hype-driven industry.

Via The Motley Fool · January 13, 2026

West Texas Intermediate (WTI) crude oil futures surged to a two-month high of $61.15 per barrel on January 13, 2026, marking a significant technical breakout that has caught market participants off guard. The price action, which saw WTI climb more than $4 over a four-day rally, was triggered by

Via MarketMinute · January 13, 2026

On Jan. 13, 2026, a bullish analyst call and sold-out AI server capacity reframed this chip giant’s turnaround potential.

Via The Motley Fool · January 13, 2026

As of January 13, 2026, the global financial landscape has been fundamentally reshaped by a precious metal that refuses to yield. Gold prices are currently holding steady near a staggering record high of $4,600 per ounce, a milestone that just two years ago seemed like a distant peak. This

Via MarketMinute · January 13, 2026

As of mid-January 2026, the global financial markets find themselves in a state of precarious euphoria. The S&P 500 Information Technology Index is hovering near an all-time high of 5,688 points, buoyed by a sector-wide earnings-per-share (EPS) growth rate that continues to exceed 20%. Yet, beneath this veneer

Via MarketMinute · January 13, 2026

As of January 13, 2026, the financial landscape has undergone a dramatic transformation, marked by a decisive "regime shift" that many Wall Street analysts are calling the "Great Rotation." For the first two weeks of the year, the Russell 2000 Index, the primary benchmark for small-cap stocks, has sprinted to

Via MarketMinute · January 13, 2026

Intel Corporation (NASDAQ: INTC) saw its shares skyrocket by more than 7% on Tuesday, marking a pivotal turning point for the semiconductor pioneer. The stock jumped 7.3% to close at $46.68, hitting an intraday high of $47.47—its highest level in nearly two years. This surge was

Via MarketMinute · January 13, 2026

In a jarring start to the second week of 2026, shares of Salesforce (NYSE: CRM) plummeted nearly 7% on Tuesday, marking the cloud giant’s steepest single-day decline since May 2024. The sharp sell-off, which led the Dow Jones Industrial Average’s 400-point retreat, signaled a growing impatience among investors

Via MarketMinute · January 13, 2026