Since April 2020, the S&P 500 has delivered a total return of 92.4%. But one standout stock has nearly doubled the market - over the past five years, DistributionNOW has surged 162% to $15.52 per share. Its momentum hasn’t stopped as it’s also gained 29.5% in the last six months thanks to its solid quarterly results, beating the S&P by 34.9%.

Is now the time to buy DistributionNOW, or should you be careful about including it in your portfolio? Check out our in-depth research report to see what our analysts have to say, it’s free.

Despite the momentum, we're swiping left on DistributionNOW for now. Here are three reasons why DNOW doesn't excite us and a stock we'd rather own.

Why Do We Think DistributionNOW Will Underperform?

Spun off from National Oilwell Varco, DistributionNOW (NYSE:DNOW) provides distribution and supply chain solutions for the energy and industrial end markets.

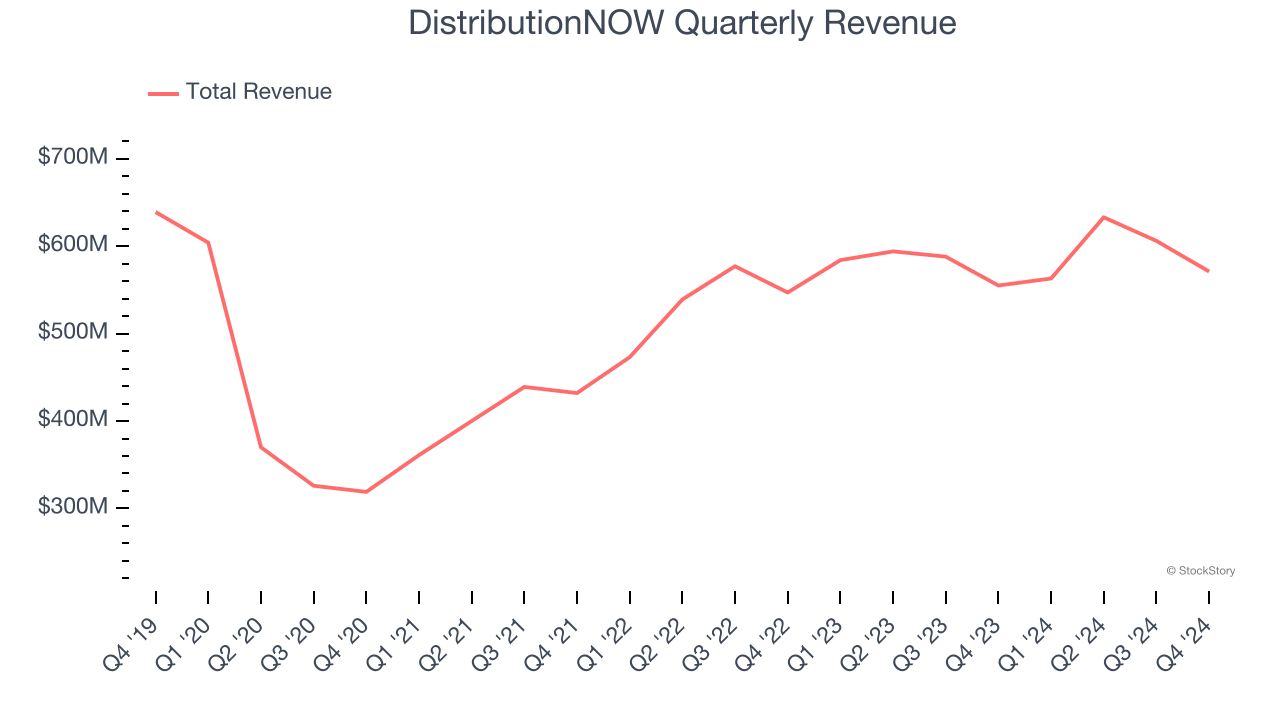

1. Revenue Spiraling Downwards

A company’s long-term performance is an indicator of its overall quality. Any business can have short-term success, but a top-tier one grows for years. DistributionNOW’s demand was weak over the last five years as its sales fell at a 4.3% annual rate. This wasn’t a great result and is a sign of poor business quality.

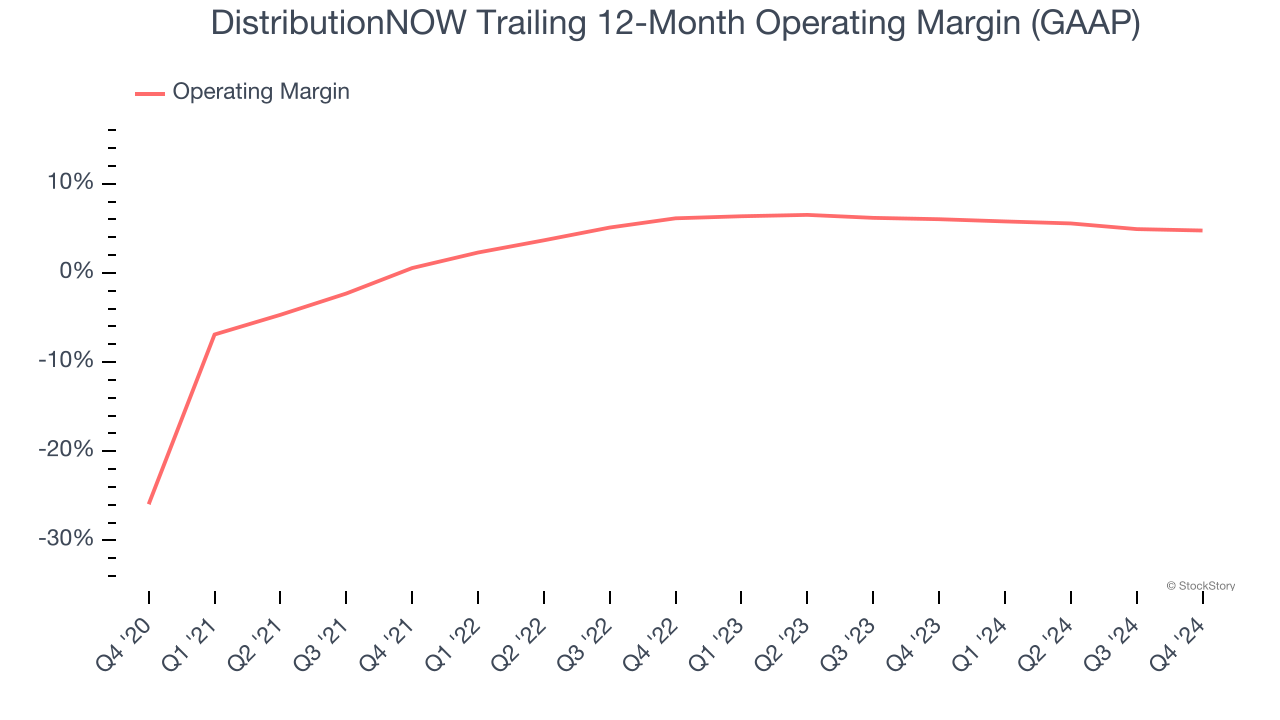

2. Breakeven Operating Raises Questions

Operating margin is one of the best measures of profitability because it tells us how much money a company takes home after procuring and manufacturing its products, marketing and selling those products, and most importantly, keeping them relevant through research and development.

DistributionNOW was roughly breakeven when averaging the last five years of quarterly operating profits, one of the worst outcomes in the industrials sector. This result isn’t too surprising given its low gross margin as a starting point.

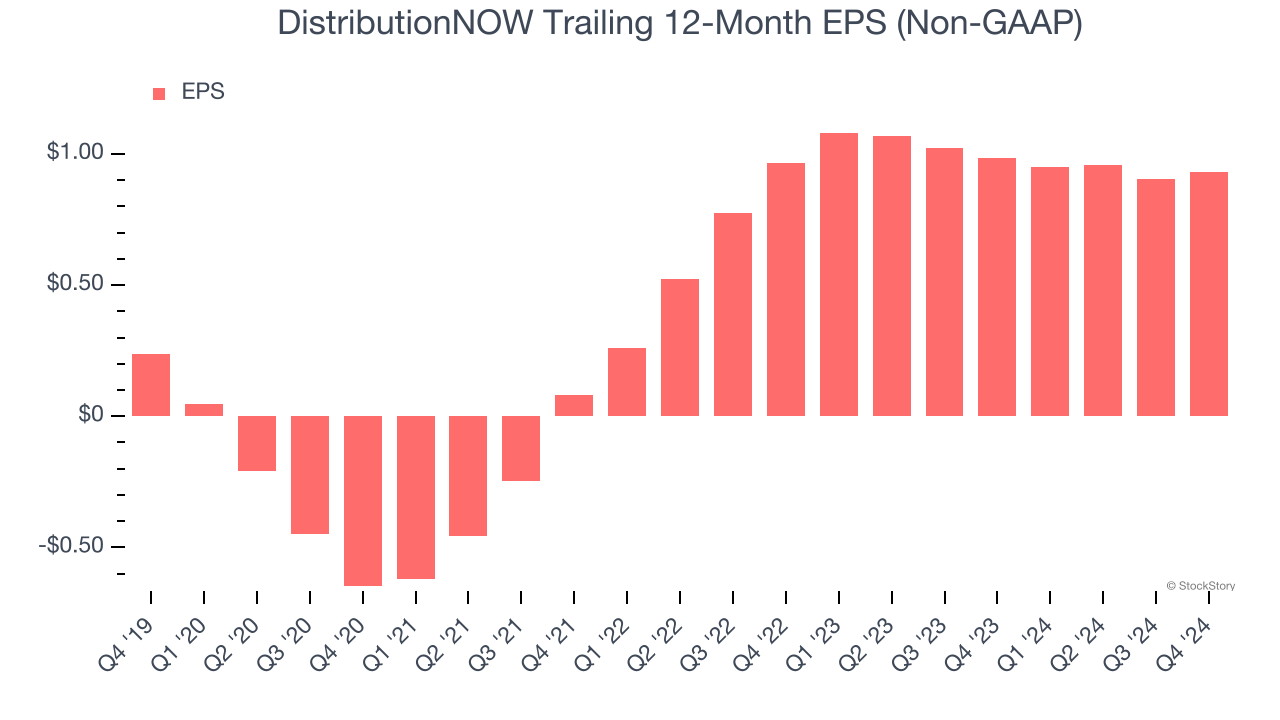

3. EPS Took a Dip Over the Last Two Years

Although long-term earnings trends give us the big picture, we like to analyze EPS over a shorter period to see if we are missing a change in the business.

Sadly for DistributionNOW, its EPS declined by 1.7% annually over the last two years while its revenue grew by 5.4%. This tells us the company became less profitable on a per-share basis as it expanded.

Final Judgment

We see the value of companies helping their customers, but in the case of DistributionNOW, we’re out. With its shares beating the market recently, the stock trades at 20.4× forward price-to-earnings (or $15.52 per share). This valuation tells us a lot of optimism is priced in - we think there are better investment opportunities out there. We’d suggest looking at our favorite semiconductor picks and shovels play.

Stocks We Would Buy Instead of DistributionNOW

Donald Trump’s victory in the 2024 U.S. Presidential Election sent major indices to all-time highs, but stocks have retraced as investors debate the health of the economy and the potential impact of tariffs.

While this leaves much uncertainty around 2025, a few companies are poised for long-term gains regardless of the political or macroeconomic climate, like our Top 6 Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,183% between December 2019 and December 2024) as well as under-the-radar businesses like Comfort Systems (+751% five-year return). Find your next big winner with StockStory today for free.