Over the last six months, Home Depot’s shares have sunk to $385.41, producing a disappointing 6.9% loss - a stark contrast to the S&P 500’s 3.6% gain. This was partly due to its softer quarterly results and might have investors contemplating their next move.

Is there a buying opportunity in Home Depot, or does it present a risk to your portfolio? Check out our in-depth research report to see what our analysts have to say, it’s free.

Why Is Home Depot Not Exciting?

Even with the cheaper entry price, we're swiping left on Home Depot for now. Here are three reasons why you should be careful with HD and a stock we'd rather own.

1. Shrinking Same-Store Sales Indicate Waning Demand

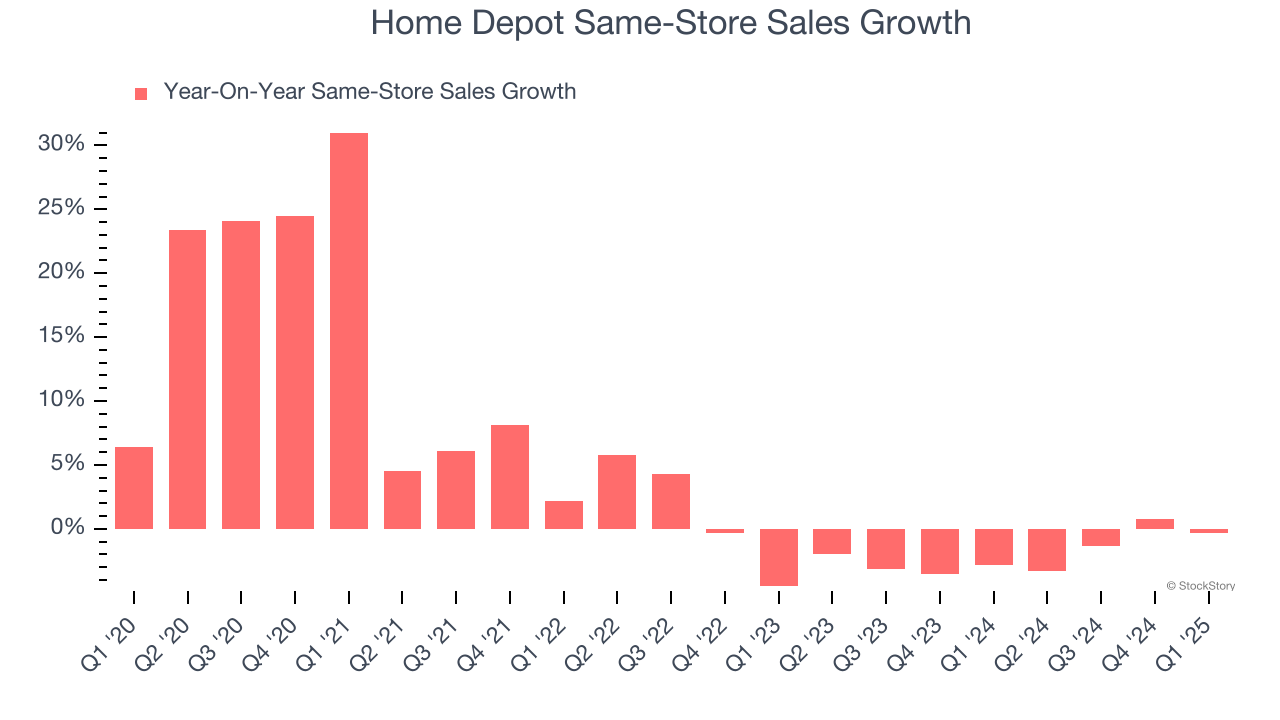

Same-store sales show the change in sales for a retailer's e-commerce platform and brick-and-mortar shops that have existed for at least a year. This is a key performance indicator because it measures organic growth.

Home Depot’s demand has been shrinking over the last two years as its same-store sales have averaged 1.9% annual declines.

2. Projected Revenue Growth Is Slim

Forecasted revenues by Wall Street analysts signal a company’s potential. Predictions may not always be accurate, but accelerating growth typically boosts valuation multiples and stock prices while slowing growth does the opposite.

Over the next 12 months, sell-side analysts expect Home Depot’s revenue to rise by 1.6%, a deceleration versus This projection doesn't excite us and implies its products will face some demand challenges.

3. Free Cash Flow Margin Dropping

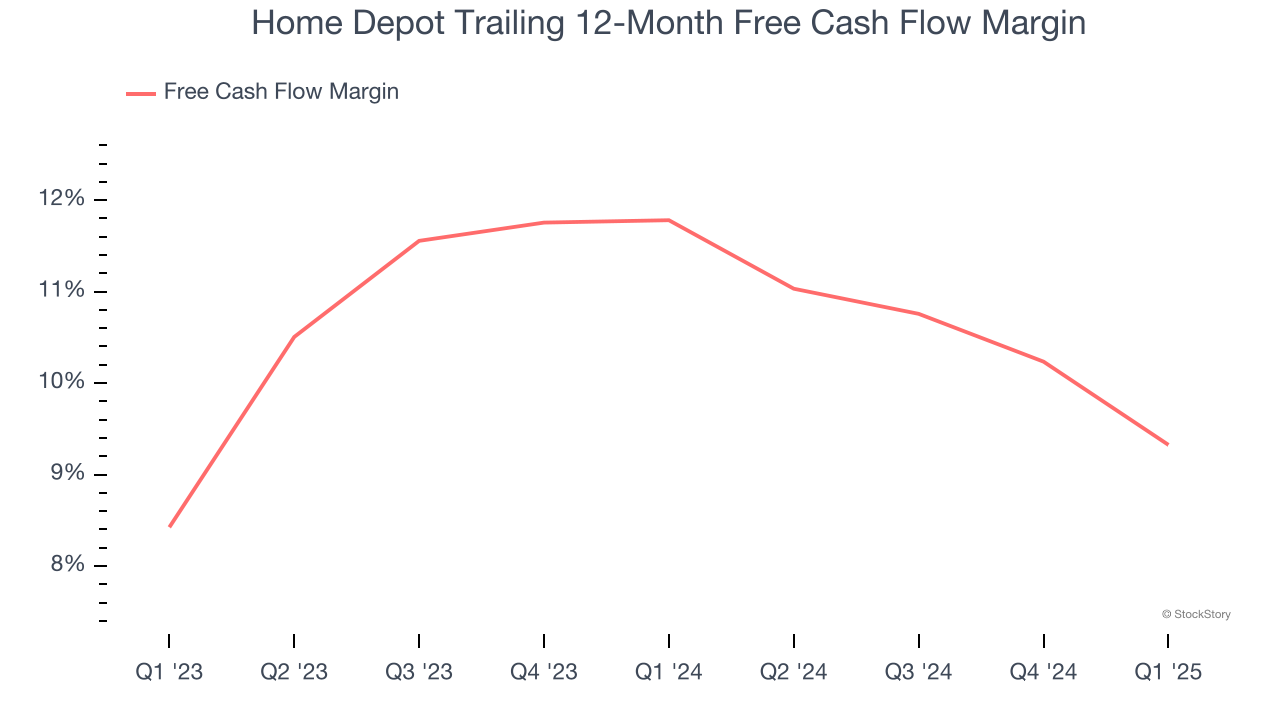

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

As you can see below, Home Depot’s margin dropped by 2.5 percentage points over the last year. This decrease warrants extra caution because Home Depot failed to grow its same-store sales. Its cash profitability could decay further if it tries to reignite growth by opening new stores.

Final Judgment

Home Depot isn’t a terrible business, but it doesn’t pass our quality test. After the recent drawdown, the stock trades at 25.1× forward P/E (or $385.41 per share). At this valuation, there’s a lot of good news priced in - you can find more timely opportunities elsewhere. Let us point you toward one of our top software and edge computing picks.

High-Quality Stocks for All Market Conditions

When Trump unveiled his aggressive tariff plan in April 2024, markets tanked as investors feared a full-blown trade war. But those who panicked and sold missed the subsequent rebound that’s already erased most losses.

Don’t let fear keep you from great opportunities and take a look at Top 5 Strong Momentum Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-micro-cap company Kadant (+351% five-year return). Find your next big winner with StockStory today.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.