Latest News

As the calendar turned to January 2026, the S&P 500 carved out a historic milestone, surmounting the psychological 7,000 level for the first time. This rally, coming off the heels of a robust 2025, initially appeared to be a continuation of the artificial intelligence-driven "melt-up" that has defined

Via MarketMinute · January 19, 2026

Via Benzinga · January 19, 2026

As we navigate the opening weeks of 2026, the semiconductor landscape is undergoing a fundamental shift. While the "AI Gold Rush" of 2023 and 2024 was defined by the massive data center GPUs of Nvidia, the narrative in 2026 has moved to the "Edge." Today, on January 19, 2026, Skyworks Solutions, Inc. (Nasdaq: SWKS) finds [...]

Via Finterra · January 19, 2026

The global financial landscape has been fundamentally reshaped this week as gold prices surged to a historic high of $4,635 per ounce, a staggering rally that has left traditional analysts scrambling to recalibrate their models. This unprecedented ascent—marking a nearly 100% increase over the past 24 months—is

Via MarketMinute · January 19, 2026

Silver was up nearly 148 percent in 2025, and the price has continued to climb in the new year, trading over $90 an ounce.

Via Talk Markets · January 19, 2026

As we enter early 2026, Target Corporation (NYSE: TGT) finds itself at one of the most critical junctures in its 124-year history. Long celebrated as the "cheap chic" alternative to traditional big-box retailers, Target has spent the last 24 months grappling with a perfect storm of macroeconomic headwinds, shifting consumer sentiment, and operational hurdles. From [...]

Via Finterra · January 19, 2026

In a move that has sent shockwaves through the American financial sector, a bipartisan coalition of lawmakers and the White House have intensified their push for a federal 10% cap on credit card interest rates. The proposal, which aims to curb "predatory" lending in an era of persistent inflation, has

Via MarketMinute · January 19, 2026

Southern Company is all set to announce its fiscal fourth-quarter earnings next month, and analysts project a double-digit earnings growth.

Via Barchart.com · January 19, 2026

As of January 19, 2026, Amazon.com, Inc. (NASDAQ: AMZN) has effectively transcended its identity as the "Everything Store." In the three decades since its inception, the company has evolved into what analysts now describe as a "planetary utility"—a critical layer of global infrastructure powering everything from the high-performance computing required for generative AI to the [...]

Via Finterra · January 19, 2026

Via Benzinga · January 19, 2026

The global financial landscape was thrust into a state of high anxiety this week as the Department of Justice (DOJ) intensified its criminal investigation into Federal Reserve Chair Jerome Powell. The probe, which centers on alleged misrepresentations regarding the multi-billion dollar renovation of the Federal Reserve's headquarters in Washington, D.

Via MarketMinute · January 19, 2026

The following feature is presented by Finterra. Date: January 19, 2026 Ticker: Microsoft Corporation (NASDAQ: MSFT) Current Price (Approx.): $465.00 Market Cap: $3.45 Trillion Introduction As we move into early 2026, Microsoft Corporation (NASDAQ: MSFT) finds itself at a critical juncture in the "second wave" of the Artificial Intelligence revolution. While 2023 and 2024 were [...]

Via Finterra · January 19, 2026

The final act of Citigroup’s multi-year structural overhaul met with a cold reception on Wall Street this week. Despite showing significant fundamental progress in its fourth-quarter 2025 earnings report, shares of Citigroup (NYSE: C) fell 3.3% as investors weighed a revenue miss against a backdrop of mounting macroeconomic

Via MarketMinute · January 19, 2026

Via Benzinga · January 19, 2026

Consolidated Edison is expected to announce its fiscal fourth-quarter earnings next month, and analysts project a double-digit profit decline.

Via Barchart.com · January 19, 2026

Today’s Date: January 19, 2026 Introduction As we enter 2026, Meta Platforms (NASDAQ: META) has successfully navigated one of the most complex corporate transformations in modern history. Once written off by many analysts during the "metaverse winter" of 2022, the company has reinvented itself not just as a social media giant, but as a vertically [...]

Via Finterra · January 19, 2026

In a definitive shift that has sent ripples through global commodity markets, a landmark report released on January 18, 2026, by the Green Finance & Development Center (GFDC) and Griffith University has unveiled a massive resurgence in China’s Belt and Road Initiative (BRI). Beijing has committed a record-breaking $213.5

Via MarketMinute · January 19, 2026

Via Benzinga · January 19, 2026

Via Benzinga · January 19, 2026

Investors sent shares of Bank of America (NYSE: BAC) tumbling 3.8% this week, a sharp reaction that underscored growing anxiety over the banking giant's ability to maintain its momentum in a cooling economy. Despite reporting fourth-quarter earnings that surpassed analyst expectations on both the top and bottom lines, the

Via MarketMinute · January 19, 2026

Each one of them brings something special -- and something very necessary -- to the table.

Via The Motley Fool · January 19, 2026

Today’s Date: January 19, 2026 Introduction In the financial annals of the mid-2020s, the most significant story wasn’t found in a Silicon Valley garage or a generative AI software lab, but in the control rooms of massive nuclear reactors in the Rust Belt and Texas. Vistra Corp (NYSE: VST) has emerged as the unlikely protagonist [...]

Via Finterra · January 19, 2026

The global energy market experienced a sharp recalibration on Thursday, January 15, 2026, as oil futures tumbled by more than 4% in a single session. The sudden sell-off was triggered by a rapid de-escalation of rhetoric between Washington and Tehran, effectively neutralizing the "geopolitical risk premium" that had bolstered prices

Via MarketMinute · January 19, 2026

Alliant Energy is scheduled to announce its fiscal fourth-quarter earnings soon, and analysts project a double-digit earnings drop.

Via Barchart.com · January 19, 2026

In a stark reminder that regulatory relief does not guarantee immediate financial prosperity, shares of Wells Fargo & Co. (NYSE: WFC) plummeted 4.61% on Wednesday, January 14, 2026, after the lender reported fourth-quarter 2025 results that failed to meet Wall Street’s revenue expectations. The decline, which saw the stock

Via MarketMinute · January 19, 2026

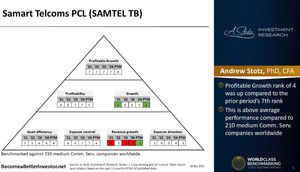

Samart Telcoms Public Company Limited is an ICT System Integrator and telecom solution provider.

Via Talk Markets · January 19, 2026

Via Benzinga · January 19, 2026

Date: January 19, 2026 Author: Finterra Research Team Introduction As the opening bell prepares to ring on a new week, all eyes in the industrial sector are fixed on St. Paul. 3M Company (NYSE: MMM), once the poster child for "litigation-induced value traps," has undergone a metamorphosis over the last 24 months. Today, on the [...]

Via Finterra · January 19, 2026

As of January 19, 2026, the global energy landscape is witnessing a rare and stark decoupling of its two most vital commodities. While West Texas Intermediate (WTI) crude oil has slid toward the $59 per barrel mark—a level not seen consistently since the post-pandemic recovery—natural gas prices have

Via MarketMinute · January 19, 2026

Via Benzinga · January 19, 2026

Via Benzinga · January 19, 2026

Via Benzinga · January 19, 2026

Via Benzinga · January 19, 2026

Via Benzinga · January 19, 2026

Via Benzinga · January 19, 2026

Via Benzinga · January 19, 2026

Broadcom shares retreated amid short-term pressure. Wells Fargo views this pullback as a potential buying opportunity.

Via Barchart.com · January 19, 2026

The global financial landscape in early 2026 finds itself at a peculiar crossroads, and at the center of this transition sits Visa Inc. (NYSE: V). Long considered the ultimate "toll-bridge" of the global economy, the company is navigating a complex environment defined by robust cross-border travel, a "K-shaped" consumer recovery, and a legislative storm brewing [...]

Via Finterra · January 19, 2026

CHICAGO — The cattle market, which had been charging through the early weeks of 2026 with historic momentum, hit a punishing wall on Friday, January 16. In a session that sent shockwaves through the agricultural sector, feeder cattle futures experienced a staggering collapse, with some contracts falling by more than $8

Via MarketMinute · January 19, 2026

In a move that underscores the shifting tectonic plates of global energy security, Mitsubishi Corporation (TYO: 8058) announced on January 16, 2026, its definitive agreement to acquire the U.S. shale production and infrastructure assets of Aethon Energy Management for a staggering $7.53 billion. The deal, backed by the

Via MarketMinute · January 19, 2026