Amazon.com (AMZN)

239.30

-2.43 (-1.01%)

NASDAQ · Last Trade: Feb 1st, 6:38 AM EST

According to the latest movement, AI could be more disruptive than we thought.

Via The Motley Fool · January 31, 2026

Rising adoption of generative AI models from OpenAI and Anthropic directly affects the major cloud computing platforms.

Via The Motley Fool · January 31, 2026

These top-quality stocks are on sale right now.

Via The Motley Fool · January 31, 2026

Salesforce and SentinelOne stocks saw insider buying heading into the new year.

Via The Motley Fool · January 31, 2026

Broadcom remains one of the best artificial intelligence (AI) stocks for long-term investors to buy now.

Via The Motley Fool · January 31, 2026

Costco is one of the dominant players in the retail sector.

Via The Motley Fool · January 31, 2026

Via MarketBeat · January 31, 2026

Industry research forecasts that AI hyperscalers will spend at least $500 billion on infrastructure in 2026.

Via The Motley Fool · January 31, 2026

It remains a compelling investment.

Via The Motley Fool · January 31, 2026

Rivian is making progress toward its big 2026 goal, but is it worth buying before that goal is hit?

Via The Motley Fool · January 31, 2026

Amazon.com is asking the FCC for a two-year extension on its 1,600-satellite deployment deadline for its $10 billion Amazon Leo internet network, citing rocket shortages and launch delays, as it aims to catch up with SpaceX's Starlink while warning that denying the extension could slow U.S. broadband expansion.

Via Benzinga · January 31, 2026

The Vanguard Information Technology ETF is missing some key long-term pieces.

Via The Motley Fool · January 31, 2026

FactSet delivers integrated financial data and analytics to institutional clients, supporting investment decisions worldwide.

Via The Motley Fool · January 30, 2026

AUSTIN, TX — In a move that could redefine the global technology and aerospace landscape, reports have surfaced that Elon Musk is considering a massive corporate consolidation, potentially merging the private aerospace giant SpaceX with either Tesla (NASDAQ: TSLA) or his rapidly growing AI startup, xAI. The rumors, which reached a

Via MarketMinute · January 30, 2026

Reports surfaced this week that Amazon.com, Inc. (NASDAQ:AMZN) is in advanced negotiations to invest a staggering $50 billion into OpenAI, the world’s leading artificial intelligence laboratory. This potential deal, first reported by major financial outlets on January 29, 2026, marks a seismic shift in the "AI Arms

Via MarketMinute · January 30, 2026

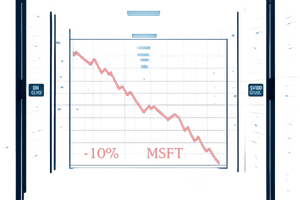

In a jarring reminder that even the world’s most valuable companies are not immune to the gravity of market expectations, Microsoft Corp. (NASDAQ:MSFT) saw its shares plunge nearly 10% following its Q2 FY2026 earnings report on January 28, 2026. Despite beating top and bottom-line estimates with total revenue

Via MarketMinute · January 30, 2026

OpenAI and Anthropic are expected to have IPOs in 2026, potentially driving up AI infrastructure spending and benefiting companies like Nvidia, Amazon, and Microsoft.

Via Benzinga · January 30, 2026

The American consumer is beginning to see a light at the end of the inflationary tunnel. According to the final January 2026 reading from the University of Michigan Survey of Consumers, one-year inflation expectations have eased to 4.0%, down from 4.2% in December and a peak earlier in

Via MarketMinute · January 30, 2026

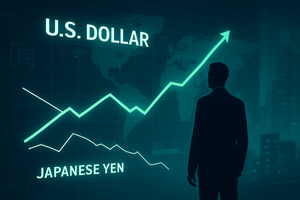

WASHINGTON D.C. — The global currency markets have been sent into a whirlwind this week as the U.S. Dollar staged a powerful recovery against the Japanese Yen. The surge followed definitive comments from U.S. Treasury Secretary Scott Bessent, who effectively shut the door on rumors of a coordinated

Via MarketMinute · January 30, 2026

The United States labor market once again demonstrated its remarkable durability as initial jobless claims for the week ending January 24, 2026, fell to a seasonally adjusted 200,000. This figure arrived significantly lower than the consensus forecast of 206,000, signaling that despite high interest rates and a cooling

Via MarketMinute · January 30, 2026

SEATTLE — In a move that has sent tremors through Silicon Valley and Wall Street, reports surfaced today, January 30, 2026, that Amazon.com Inc. (NASDAQ:AMZN) is in advanced negotiations to invest a staggering $50 billion into OpenAI. This unprecedented capital injection, if finalized, would mark the largest single investment

Via MarketMinute · January 30, 2026

The little EV maker still has a lot to prove.

Via The Motley Fool · January 30, 2026

As the global demand for artificial intelligence continues to spiral, the industry has hit a formidable roadblock: the "energy wall." With massive Large Language Models (LLMs) consuming megawatts of power and pushing data center grids to their breaking point, the race for a more sustainable computing architecture has moved from the fringes of research to [...]

Via TokenRing AI · January 30, 2026

Tighter Medicare Advantage payment rates are testing two established health insurers, with CVS Health offering a safer dividend entry at 28% upside and 3% yield while Humana's 36% year-over-year decline creates a riskier but potentially stronger boun...

Via Barchart.com · January 30, 2026