Deere & Co (DE)

600.84

-2.08 (-0.34%)

NYSE · Last Trade: Feb 17th, 10:36 PM EST

Agricultural and construction machinery company Deere (NYSE:DE) will be reporting earnings this Thursday before market open. Here’s what you need to know.

Via StockStory · February 17, 2026

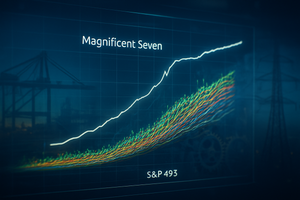

The opening weeks of 2026 have witnessed a tectonic shift in global capital markets, marking what analysts are calling the "Great Sector Rotation." After three years of relentless dominance by artificial intelligence and cloud computing giants, the tide has abruptly turned. Investors are staging a massive exodus from high-multiple Software-as-a-Service

Via MarketMinute · February 17, 2026

Despite recent volatility, trends like artificial intelligence could fuel another strong year for the stock market.

Via The Motley Fool · February 17, 2026

NEW YORK — As of February 17, 2026, the long-reigning kings of Silicon Valley are facing a cold front on Wall Street. In a dramatic reversal of the trends that defined the early 2020s, the "Mega Cap 8" growth stocks are witnessing a sustained sell-off, while investors flock to the once-ignored

Via MarketMinute · February 17, 2026

The American agricultural heartland is breathing a collective sigh of relief this week as reports of a significant breakthrough in US-China trade relations signal a potential windfall for domestic soybean producers. Following a high-stakes telephone conversation in early February 2026 between President Donald Trump and President Xi Jinping, the two

Via MarketMinute · February 17, 2026

On the morning of February 17, 2026, Allegion plc (NYSE: ALLE) became the focal point of the industrial and technology sectors as its shares surged nearly 6% in pre-market trading. The catalyst for this significant move was a combination of record-breaking fourth-quarter earnings for 2025 and a surprisingly robust guidance outlook for the 2026 fiscal [...]

Via Finterra · February 17, 2026

The American agricultural landscape is witnessing a dramatic recalibration following the U.S. Department of Agriculture’s (USDA) February 10, 2026, World Agricultural Supply and Demand Estimates (WASDE) report. In a move that caught many commodity analysts off guard, the USDA slashed its projection for corn ending stocks to 2.

Via MarketMinute · February 17, 2026

The global agricultural market is grappling with a profound correction as the "commodities super-cycle" of the early 2020s appears to have hit a definitive wall. In a stunning reversal of the record highs seen throughout 2025, prices for essential staples—including corn, wheat, and coffee—have tumbled by as much

Via MarketMinute · February 17, 2026

Listen in as Motley Fool co-founder Tom Gardner and Chief Investment Officer Andy Cross talk about stocks!

Via The Motley Fool · February 17, 2026

NEW YORK — In a resounding signal that the American industrial heartland has finally shaken off its post-pandemic lethargy, the U.S. manufacturing sector roared back into expansion territory in January 2026. The Institute for Supply Management (ISM) reported on February 2nd that its Manufacturing PMI rose to 52.6 last

Via MarketMinute · February 16, 2026

The U.S. Department of Agriculture (USDA) sent a wave of relief through the agricultural sector this week with the release of its February 2026 World Agricultural Supply and Demand Estimates (WASDE) report. Defying expectations of a mounting supply glut following last year’s historic production, the agency slashed projected

Via MarketMinute · February 16, 2026

Soybean futures have experienced a dramatic 60-cent rally over the past two weeks, as market optimism builds around a potential breakthrough in US-China trade relations. Reports circulating in Washington and Beijing suggest that President Trump and President Xi Jinping are finalizing plans for a high-stakes summit in April 2026. The

Via MarketMinute · February 16, 2026

The stocks featured in this article have all approached their 52-week highs.

When these price levels hit, it typically signals strong business execution, positive market sentiment, or significant industry tailwinds.

Via StockStory · February 15, 2026

Even if they go mostly unnoticed, industrial businesses are the backbone of our country. Their momentum is also rising as lower interest rates have incentivized higher capital spending.

As a result, the industry has posted a 21.9% gain over the past six months, beating the S&P 500 by 16 percentage points.

Via StockStory · February 15, 2026

Construction and farm equipment makers are benefiting from strong spending.

Via The Motley Fool · February 12, 2026

As of February 12, 2026, Caterpillar Inc. (NYSE: CAT) stands as a formidable bellwether for the global economy, transitioning from its centenary year into a new era of autonomous heavy machinery and energy transition infrastructure. Often referred to simply as "Cat," the company is the world’s leading manufacturer of construction and mining equipment, diesel and [...]

Via Finterra · February 12, 2026

The S&P 500 Index retreated further from its historic peaks on Wednesday, closing at 6,914.75, a decline of 0.39% for the session. This pullback marks a significant cooling period for a market that only weeks ago, on January 28, 2026, celebrated a record-shattering high of 7,

Via MarketMinute · February 11, 2026

The American wheat market faced a wave of selling pressure this week following the release of the U.S. Department of Agriculture’s (USDA) February World Agricultural Supply and Demand Estimates (WASDE) report. The report, a critical barometer for global food commodities, stunned traders by upwardly revising U.S. wheat

Via MarketMinute · February 11, 2026

In a surprising turn of events for the global agricultural markets, the U.S. Department of Agriculture (USDA) released its February 2026 World Agricultural Supply and Demand Estimates (WASDE) report, delivering a significant boost to the American corn outlook. Defying a prevailing market consensus that expected a neutral to slightly

Via MarketMinute · February 11, 2026

Agriculture products company SiteOne Landscape Supply (NYSE:SITE) missed Wall Street’s revenue expectations in Q4 CY2025 as sales rose 3.2% year on year to $1.05 billion. Its GAAP loss of $0.20 per share was 35% above analysts’ consensus estimates.

Via StockStory · February 11, 2026

As of February 10, 2026, the long-standing "two-speed" economy that defined the post-pandemic era has finally reached a historic turning point. For years, a handful of mega-cap technology titans—the "Magnificent Seven"—carried the weight of the entire U.S. stock market on their shoulders, while the remaining 493 companies

Via MarketMinute · February 10, 2026

Via MarketBeat · February 9, 2026

The U.S. industrial sector has finally signaled a definitive end to its prolonged period of stagnation, with the Institute for Supply Management (ISM) reporting that the Manufacturing PMI surged to 52.6% in January 2026. This reading marks the first significant expansion for the sector in over a year,

Via MarketMinute · February 9, 2026

In a stunning reversal of a year-long industrial malaise, the U.S. manufacturing sector roared back to life this week as the Institute for Supply Management (ISM) released its latest Purchasing Managers' Index (PMI) data. The report, made public on February 6, 2026, showed the manufacturing PMI climbing to a

Via MarketMinute · February 6, 2026