Goldman Sachs Group (GS)

935.41

+0.00 (0.00%)

NYSE · Last Trade: Feb 2nd, 7:19 AM EST

Caution is warranted, but investors can still find great opportunities.

Via The Motley Fool · February 2, 2026

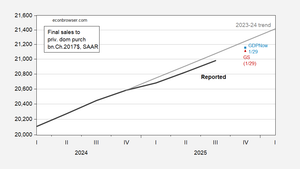

From Atlanta Fed and Goldman Sachs, numbers that perhaps better represent the trajectory of aggregate demand.

Via Talk Markets · February 2, 2026

He stated that U.S. liquidity had also been constrained by the two government shutdowns and by inflows into the U.S. Treasury, which had nowhere to go.

Via Stocktwits · February 2, 2026

Contrary to a common assumption, not all utility stocks are the same.

Via The Motley Fool · February 1, 2026

The cloud firm has faced scrutiny over its debt-fueled buildout of AI infrastructure, which has pressured its shares in recent months.

Via Stocktwits · February 1, 2026

The prediction market landscape has officially entered its most volatile and high-stakes era yet. Following a staggering 2025 that saw over $40 billion in total trading volume, the industry is now locked in what analysts are calling the "Great Prediction War." This isn't just a race for market share; it is a fundamental clash between [...]

Via PredictStreet · February 1, 2026

Accelerating investment in AI infrastructure will remain a strong tailwind for chip stocks -- and not just the GPU specialists.

Via The Motley Fool · January 31, 2026

Industry research forecasts that AI hyperscalers will spend at least $500 billion on infrastructure in 2026.

Via The Motley Fool · January 31, 2026

In a year marked by a significant "lower for longer" pricing environment and shifting global energy dynamics, Chevron Corporation (NYSE: CVX) reported a resilient fourth-quarter 2025 performance that exceeded analyst expectations on the bottom line. Despite facing a sharp decline in average Brent crude prices—averaging $69 per barrel in

Via MarketMinute · January 30, 2026

The financial markets were jolted on January 30, 2026, as the Bureau of Labor Statistics (BLS) released Producer Price Index (PPI) data for December 2025 that was significantly "warmer" than any analyst had predicted. Headline PPI rose 0.5% month-over-month, more than double the consensus estimate of 0.2%, while

Via MarketMinute · January 30, 2026

In a move that sent immediate shockwaves through global financial markets, President Donald Trump officially nominated former Federal Reserve Governor Kevin Warsh to succeed Jerome Powell as the Chair of the Federal Reserve. The announcement, made on the morning of January 30, 2026, represents a fundamental shift in the leadership

Via MarketMinute · January 30, 2026

The company reported revenue of $3.02 billion for the quarter, 25% higher compared to the same period last year, and above analyst estimates of $2.9 billion.

Via Stocktwits · January 30, 2026

Goldman Sachs gave the salad stock a thumbs-down.

Via The Motley Fool · January 30, 2026

One increase was modest, while the other represented a double-digit percentage improvement.

Via The Motley Fool · January 30, 2026

In a move that signals a seismic shift in American monetary policy, President Donald Trump has officially nominated former Federal Reserve Governor Kevin Warsh to succeed Jerome Powell as the Chair of the Federal Reserve. The announcement, made on January 30, 2026, marks the beginning of the end for the

Via MarketMinute · January 30, 2026

Is Bitcoin a bargain below $90,000? Here's what the bulls and bears are saying.

Via The Motley Fool · January 30, 2026

As we enter the first quarter of 2026, a fundamental shift is occurring in the architecture of global finance. For decades, institutional trading desks relied on the "terminal" model—terminal data from legacy providers, consensus surveys, and government reports—to price risk. Today, that hierarchy has been inverted. Algorithmic trading bots are no longer just participants in [...]

Via PredictStreet · January 30, 2026

In a move that has sent shockwaves through global financial markets, President Donald Trump has officially nominated Kevin Warsh to succeed Jerome Powell as the next Chairman of the Federal Reserve. The announcement, made on the morning of January 30, 2026, marks the culmination of a year-long campaign by the

Via MarketMinute · January 30, 2026

In a definitive signal that the "cash sorting" crisis of years past has been relegated to the history books, The Charles Schwab Corporation (NYSE: SCHW) reported record-breaking fourth-quarter and full-year 2025 results on January 21, 2026. The brokerage behemoth posted a record $6.34 billion in quarterly revenue, a 19%

Via MarketMinute · January 30, 2026

As January 2026 draws to a close, the global financial markets are standing at the precipice of what many economists are calling the "AI Earnings Supercycle." After three years of intensive capital expenditure and experimental pilots, the narrative of artificial intelligence has shifted from speculative hype to a rigorous, margin-focused

Via MarketMinute · January 30, 2026

Despite strong growth, full-year guidance remains unchanged, why this Goldman Sachs analyst maintains a Buy rating and changes the stock price target.

Via Benzinga · January 30, 2026

Interactive Brokers has outperformed the broader market over the past year, and analysts are highly optimistic about the stock’s prospects.

Via Barchart.com · January 30, 2026

The SPDR Gold Shares ETF has crushed Bitcoin, Nvidia, and the entire S&P 500 this year.

Via The Motley Fool · January 30, 2026

The price of gold hit a new milestone this week.

Via The Motley Fool · January 29, 2026

As of January 29, 2026, the global energy landscape has been thrust into a state of high alert, with Brent Crude prices surging to $70.90 per barrel, marking their highest level in over six months. This rapid ascent—a nearly 15% jump in January alone—has caught traders off

Via MarketMinute · January 29, 2026